Choosing the right health insurance plan can significantly impact your financial well-being and access to healthcare. This year’s options present a variety of choices, from traditional plans to more innovative approaches. Understanding the different types of coverage is key to finding the best fit for your needs. Factors like your income, family size, and health conditions play a role in determining the most suitable plan. Consider your current medical expenses and potential future needs when evaluating different options. Researching different providers and their coverage networks is also essential. Don’t hesitate to seek professional guidance from insurance agents. They can provide personalized recommendations based on your specific circumstances. Comparing premiums, deductibles, and co-pays across various plans is a crucial step in the process. Remember to carefully review the fine print of each policy to fully understand the terms and conditions.

Nexus National Insurance Agency Expands Access to Affordable Health Coverage for Americans Nationwide

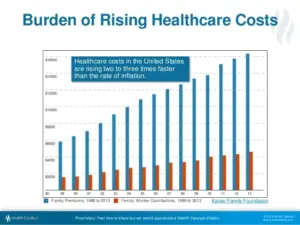

Boca Raton, FL – October 27, 2025 – As millions of Americans struggle with rising