Introduction: Why we need to talk about 2026 already

Health insurance changes often happen slowly — but when they do, they can make a big difference in what you pay, how much care you can get, and whether you stay covered. In 2026, several important shifts in the rules and subsidies (financial help from the government) are expected under the Affordable Care Act (aka “Obamacare” or the ACA).

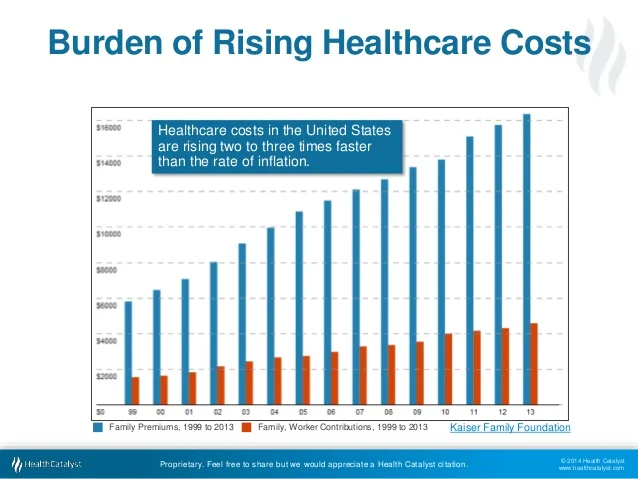

Because health care costs keep rising (see the charts above), it’s extra important to understand what’s coming — and to shop early for your plan. If you wait too late, you might get hit with surprises.

This post will break down what’s changing, who will feel it most, and what you should do now — in a way that even an eighth grader can follow.

Rising costs: the backdrop

Before diving into rules, it helps to see the bigger picture: health care is getting more expensive year after year. The first chart shows how health care spending (by government, insurers, and people) has grown over time. The second chart zooms in on premiums — what people pay for insurance — and how those keep climbing.

Because costs rise, policies and subsidies have to adjust just to stay afloat. That means changes often end up pushing more costs onto people as well.

What’s changing in 2026?

Here are the major changes coming to Obamacare / ACA rules in 2026 (or already set to begin), and how they might affect you.

1. Subsidies (financial help) may end or shrink

One of the most important changes is that the enhanced premium tax credits (extra subsidies introduced during the pandemic) are scheduled to expire at the end of 2025 — unless Congress acts to renew them. StretchDollar+2Johns Hopkins Public Health+2

If those subsidies end:

- People will have to pay more of the premium themselves — in many cases, 75 % or more higher on average. CNBC+2StretchDollar+2

- Some people who currently qualify for $0 or very cheap plans may no longer be eligible. SC Justice+1

- Those with moderate incomes (who are between, say, 100 % and 400 % of the federal poverty level) will be hit hardest. SC Justice+1

In short: your share of the cost goes up.

2. Premiums and out‑of‑pocket limits rising

Even beyond losing subsidies, rule changes will adjust how much people pay. According to the Center on Budget and Policy Priorities, the government will change “applicable percentages” and bump up the maximum out-of-pocket limits (the highest you could ever pay in a year for care). Center on Budget and Policy Priorities

This means:

- Premiums (after the tax credits) will rise more. Center on Budget and Policy Priorities+1

- The out-of-pocket maximum — the cap on your deductibles, copays, etc. — will also go up, meaning you could pay more in medical costs if you need a lot of care. Commonwealth Fund+1

One estimate: a family of four making $85,000 could pay about $313 more in premiums and face up to $900 more in out-of-pocket costs. Commonwealth Fund

3. More safeguards, stricter enrollment rules, and less automation

The government is finalizing new rules to tighten oversight, reduce fraud, and make the system more transparent. CMS+2CMS+2

Some of these changes:

- More checks to ensure people enrolling are really eligible. CMS+2CMS+2

- Easier to see costs and better tools on HealthCare.gov to help people understand what they’ll pay. CMS+1

- Marketplaces can’t automatically re-enroll some people into a “better” plan (for example, taking someone from a cheaper “bronze” plan to a “silver” plan) if they didn’t ask for it. CMS+1

- State-run marketplaces will have more flexibility in setting open enrollment windows (when you can sign up). CMS+2CMS+2

Also, the Open Enrollment Period itself may be changed. Exchanges will have to start no later than November 1 and end no later than December 31, with a maximum length of 9 weeks. CMS

4. Some benefits may change or be removed

- The “Essential Health Benefits” rules are being updated. Plans will have to report more publicly on quality measures. CMS+1

- Some coverage decisions will be stricter to prevent fraud and abuse. CMS+1

5. State marketplaces and transitions

Some states are preparing to change how they run their health insurance marketplace rather than using the federal platform (HealthCare.gov). For example, Illinois plans to run its own exchange in 2026. Reddit

These shifts might change how you sign up or which plans are offered in your state.

Who feels the impact, and how big will the change be?

- Low- and moderate-income families: Because these people rely most on subsidies, they’ll feel the greatest pain if subsidies expire or shrink.

- Those just above subsidy limits: If you were getting help under new rules expanded to people who earned a bit more, you might lose eligibility.

- People with high medical costs: With higher out-of-pocket caps, those needing more doctor visits or hospital stays could pay significantly more.

- State-by-state differences: Effects will vary depending on what your state does. Some may try to ease the burden; others may be more strict.

If nothing changes in Congress, many analysts expect premium increases of 60‑75 % (or more) on average for people in the ACA marketplace. Commonwealth Fund+3CNBC+3StretchDollar+3

Why you should start shopping early

Given all these changes, waiting until the last minute could be risky. Here’s why:

- Plan options might shrink

Some insurers may drop out of certain markets or states. If your current plan won’t be offered anymore, you want to have time to compare alternatives. - You’ll need more time to understand costs

With new rules, more checks, and different subsidies, it may take longer to figure out which plan gives you the best value. - Errors or delays could happen

If your enrollment is denied or delayed (say, because documentation isn’t in order), you’ll want as much buffer time as possible to fix it. - You might miss deadlines

If an open enrollment period ends earlier (e.g. December 15), missing it could leave you without coverage or stuck until next year — unless you qualify for a “special enrollment period” (for things like moving, marriage, birth, etc.). - Avoid surprise costs

When costs go up, buying early may lock in coverage before the worst increases hit.

What you can do NOW (before 2026)

Here are action steps to protect yourself:

- Monitor legislation: Watch whether Congress renews enhanced subsidies or changes rules. The final picture depends on upcoming laws.

- Estimate your 2026 cost: Use subsidy calculators (for your state) to see how your premium and out-of-pocket costs could change.

- Start comparing plans early: Don’t wait. Review plan types (bronze, silver, gold), networks, drug coverage, and total cost (not just monthly).

- Keep your documents ready: Because there will be stricter eligibility verification, make sure you have proof of income, citizenship, etc., ready to go.

- Pay attention to your state marketplace: If your state switches from HealthCare.gov to a state-run portal, get familiar with the new system.

- Advocate and communicate: Encourage your local officials or legislators to extend or preserve subsidies — changes like this often hinge on political decisions.

Final thoughts

Change is coming to Obamacare in 2026, and many of those changes lean toward higher costs and stricter rules. That might sound scary, but knowing what’s ahead gives you an advantage. By starting early — checking plans, comparing options, verifying documents — you’ll be better prepared to find a plan that fits your needs and your budget.